For years, that was my life. A total disaster. I’d use some online software, click buttons I didn’t really understand, and then just… hope for the best in Tax Planning. I’d watch those commercials for fancy financial advisors and think, “Yeah, right. They’re for people with yachts and trust funds. Not for a freelancer like me who sometimes gets paid in Venmo and has a ‘business’ expense that was mostly just a latte for a client meeting that ended up being over Zoom.”

But here’s a confession: I finally broke down and looked into tax planning services you can afford. And you guys, it wasn’t the scary, wallet-draining experience I thought it would be. It was… surprisingly human. And it changed my life. No, I’m not exaggerating. My stress levels during tax season have plummeted, and I actually feel like I have a handle on my money for once. It’s a wild feeling.

The Great Myth: “Tax Planning is Only for the Rich”

I swear, this myth is a full-on mind virus. For the longest time, I was convinced that a tax professional was this mysterious wizard in a suit who charged, like, a thousand dollars just to say “hello.” The idea of paying someone more money to save me some money seemed like a scam designed for people who didn’t care about a few hundred dollars here or there. For me, a few hundred dollars is a grocery trip and a half. So, I just kept stuffing receipts in the shoebox and winging it.

It’s a little like when you’re a kid and you think all adults know exactly what they’re doing. Then you grow up and realize we’re all just fumbling around, pretending to be competent.

My turning point came after a particularly messy year where I started a small freelance business. Suddenly, my taxes weren’t just a simple W-2. I had 1099s, weird expenses, and a whole lot of confusion. I’d sit there, staring at the screen, and my brain would just short-circuit. It was like trying to solve a Rubik’s Cube with your eyes closed.

I needed help, but I had a budget. So, I started digging. I wasn’t looking for a high-end CPA firm that would serve me sparkling water and judge my mismatched socks, looking for a real person who could help me without bankrupting me. And on a mission to find some affordable tax help.

Finding a Human on the Other Side of the Screen (Spoiler: It’s All Virtual Now)

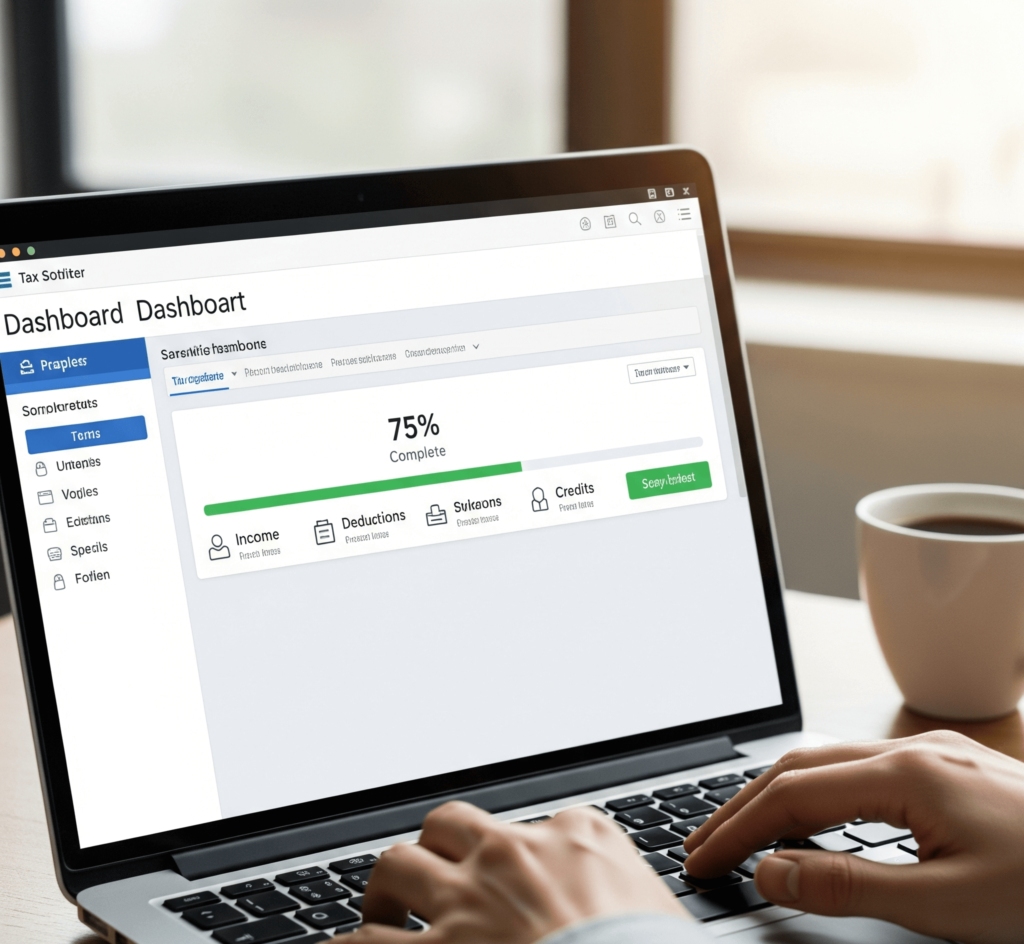

Okay, so the first thing I realized is that the world has moved on from dusty old offices and expensive, in-person meetings. A lot of the best options for us regular folks are online. We’re talking virtual tax services, people. You upload your documents, maybe jump on a video call, and boom—you’re talking to an actual expert.

I was a little skeptical at first. I mean, could a digital handshake really give me the peace of mind of a face-to-face meeting? But, honestly? It’s even better. No traffic, no finding parking, no awkward small talk about the weather while I try to explain my weird side hustle.

I used a service where I uploaded all my documents (I even scanned my shoebox receipts, which was a whole day-long saga). Then, they paired me with a cheap tax advisor—at least, they felt cheap compared to what I expected. The fee was a flat rate, which was amazing because it took the guesswork out of it. We had a video call, and I swear, within ten minutes, she had found deductions I had no idea even existed.

She was just so… normal. She talked me through everything, explained things in simple terms (like a friend would!), and didn’t make me feel stupid for not knowing what a “depreciation schedule” was. “Think of it like your laptop losing a little bit of its magical powers every year,” she said. I got it. I totally got it.

Tax Filing vs. Tax Planning: An Unsolicited Metaphor

So, here’s a big thing I learned. There’s a massive difference between tax filing and tax planning.

- Tax Filing: This is what I was doing before. It’s like looking at a burnt piece of toast and trying to figure out how to un-burn it. You’re just dealing with the mess that’s already been made. You’re reacting. You’re stressed.

- Tax Planning: This is like figuring out the perfect toaster setting before you put the bread in. It’s proactive. It’s looking at your whole year and making smart moves to reduce your tax bill later.

For example, my advisor asked me about my retirement savings. I had a little IRA I’d been contributing to. She showed me how increasing my contributions could lower my taxable income right now. It was mind-blowing. It was like a cheat code for adulting.

This is where the real value of these services lies. It’s not just about getting your forms submitted. It’s about getting real tax planning services you can afford that help you think strategically about your money all year long. This is especially true for freelancers and small business owners, where every business expense can be a potential deduction.

A Few Ways to Get Started Without Selling Your Kidney

So, you’re convinced, but you don’t know where to start. Here are a few options I found, which are a great entry point if you don’t want to spend a fortune.

- Online Tax Software with Expert Help: This is a fantastic middle ground. You do most of the data entry yourself (you’re pretty good at it now, right? wink), and then you can pay a little extra to have a human expert review everything before you file. It’s like having training wheels on a bike—you’re doing the work, but there’s a professional there to catch you if you fall.

- Virtual Tax Planning Firms: A lot of smaller, modern firms have popped up that operate 100% online. They offer packages for different levels of complexity. A lot of these services are subscription-based, which can be great for ongoing

tax strategies for freelancersand small business owners throughout the year. You can ask questions whenever you have them, not just during tax season. It’s like having a financial coach who’s only a click away. - DIY with a One-Off Consultation: If your situation is pretty simple but you have a few nagging questions, you can often find CPAs who offer a one-hour consultation for a set fee. Go in prepared with a list of questions, and you can get a ton of value without committing to a full-service package.

The ROI is Wild (and Worth Every Penny)

I should probably be embarrassed to admit this, but after my first year with my new virtual tax advisor, she found me so many deductions and credits I was missing that I saved more than double what I paid her for the service. I’m not even kidding. It was like I got a bonus for being clueless.

I remember telling my friend about it, and she looked at me and said, “So, you’re telling me you spent money to make money?” And I was like, “Yeah, that’s literally what I’m telling you! It’s like a magic trick, but with spreadsheets and tax codes.”

For us freelancers, the ROI is even more insane. I now track everything—mileage, office supplies, software subscriptions—because I know it all adds up. It’s not just about filing; it’s about a mindset shift. It’s about building good financial habits.

So, if you’re like me and you’ve been avoiding professional tax help because you think it’s too expensive or too complicated, I’m here to tell you to just take the leap. A quick Google search for tax planning services you can afford will give you a ton of options, and you can start by just exploring.

Future-you, the one who isn’t crying over a shoebox full of receipts, will seriously thank you. It’s one of the best investments I’ve ever made in myself, even better than that vintage painting I sold (and still have to figure out the capital gains on, but hey, I know who to call for that now!).

Outbound Link Suggestion:

- [A link to a well-known virtual tax service with an expert review option, like H&R Block’s online services or TurboTax Live.]

- [A link to a popular personal finance blog’s article on tax deductions for freelancers, like a post from NerdWallet or The Simple Dollar.]