This crucial provision can help protect you from tax liabilities you shouldn’t be responsible for. This guide will thoroughly explain Innocent Spouse Relief: what it entails, who qualifies, and the steps involved in claiming it. Understanding this important tax provision is the first step toward finding peace of mind and financial stability.

What is Innocent Spouse Relief? Understanding the Basics

It offers a way for one spouse to be relieved from joint tax liability, including taxes, interest, and penalties, arising from an understatement of tax on a joint income tax return. This relief is typically granted when one spouse can prove they didn’t know, and had no reason to know, about the understatement of tax. The core idea behind Innocent Spouse Relief is to prevent an unfair burden on an individual who genuinely had no knowledge of tax inaccuracies caused by their spouse.

Do You Qualify for Innocent Spouse Relief? Key Conditions

You must meet specific conditions set by the IRS. These are generally strict, and you’ll need to demonstrate several points:

- Joint Return Filed: You must have filed a joint income tax return for the year(s) in question.

- Understatement of Tax: There must be an understatement of tax directly attributable to an erroneous item of the spouse with whom you filed the joint return. An “erroneous item” includes unrecorded income or false deductions.

- Lack of Knowledge: At the time you signed the joint return, you must not have known, and had no reason to know, that there was an understatement of tax.1 This is a critical and often challenging condition to prove.

- Unfair to Hold You Liable: Taking into account all the facts and circumstances, it would be unfair to hold you liable for the understatement of tax.2 The IRS considers factors like whether you significantly benefited from the understatement, if you were later divorced or separated, and your current financial situation.

It’s important to note that the IRS considers each case individually. Meeting these conditions is crucial for your claim for Innocent Spouse Relief.

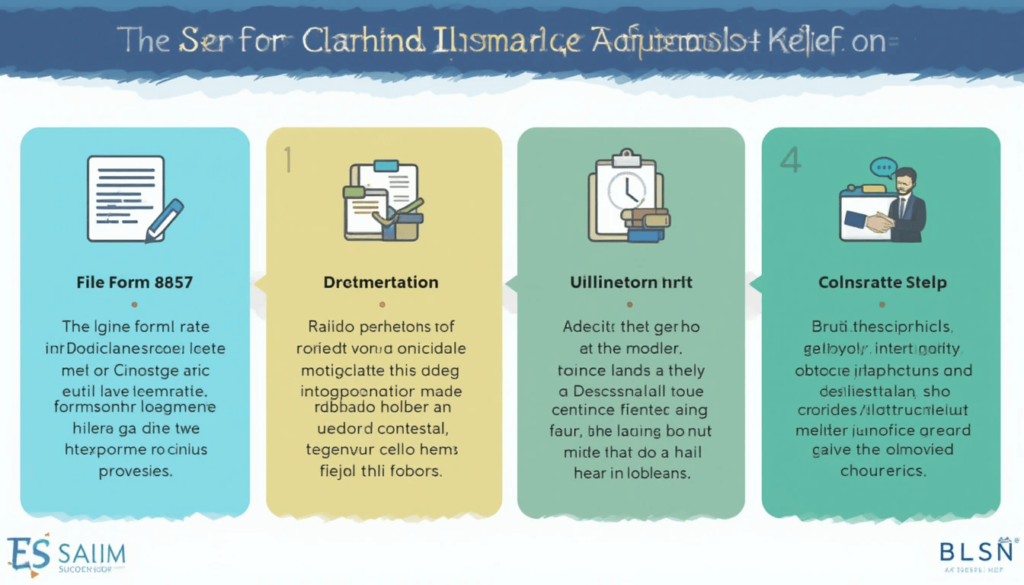

How to Claim Innocent Spouse Relief: The Application Process

Claiming Innocent Spouse Relief involves a formal application process with the IRS. Here’s a general overview of the steps:

- File Form 8857, Request for Innocent Spouse Relief: This is the primary form you’ll use to request relief. You’ll need to provide detailed information about your situation, including why you believe you qualify.

- Gather Documentation: You’ll need evidence to support your claim. This may include:

- Financial records (bank statements, pay stubs)

- Divorce or separation decrees

- Police reports (if fraud was involved)

- Correspondence with your spouse/former spouse

- Any other documents that demonstrate your lack of knowledge about the tax understatement.

- Understand the Time Limit: Generally, you must file Form 8857 no later than 2 years after the date the IRS first began collection activities against you for the tax liability. There are exceptions, so it’s always best to act promptly.

- Cooperate with the IRS: The IRS will investigate your claim. Be prepared to provide additional information or clarification as requested. They will also typically contact your spouse or former spouse regarding your claim.

- Consider Professional Help: The process can be complex. Consulting with a tax professional (like a CPA or Enrolled Agent) experienced in Innocent Spouse Relief can significantly improve your chances of success. [Outbound Link to IRS Taxpayer Advocate Service, a potential resource]

Real-World Example: A Successful Claim for Innocent Spouse Relief

Consider Jane, who divorced her husband, Mark. Years later, the IRS audited a joint return they filed together and found significant unreported income from Mark’s side business, which Jane knew nothing about. Mark handled all the finances. Jane immediately filed Form 8857, providing bank statements showing she didn’t benefit from the unreported income and detailing her lack of involvement in Mark’s business. After an IRS review, Jane was granted Innocent Spouse Relief, relieving her of the tax burden.

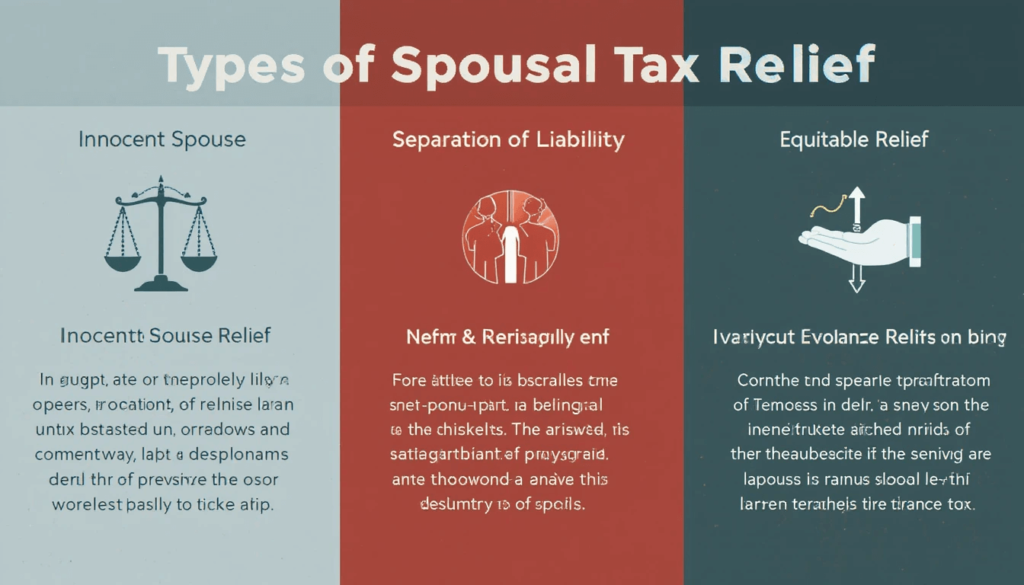

Other Types of Spousal Tax Relief

Besides Innocent Spouse Relief, the IRS offers two other forms of spousal tax relief that you might qualify for:

- Separation of Liability Relief: This relief divides the tax liability on a joint return between you and your spouse (or former spouse) based on what portion of the understatement of tax is attributable to each of you. You must generally be divorced, legally separated, or not living together.

- Equitable Relief: This is a broader form of relief. If you don’t qualify for Innocent Spouse Relief or Separation of Liability Relief, you might still qualify for equitable relief if it would be unfair to hold you responsible for the tax. The IRS considers various factors, including your financial hardship and whether you were abused by your spouse. [Outbound Link to IRS page on all types of Spousal Relief]

Understanding all available options is crucial when dealing with a joint tax liability.