Okay, let’s have a heart-to-heart, yeah? You ever just… zone out and think about the future? Like, really far future Plan? I do. Sometimes, when I’m stuck in traffic here in Jaipur (which, let me tell you, is a whole different level of “traffic jam”), my mind wanders to what life will be like when I’m old and gray(er). Will I be sipping chai on a porch swing? Finally learning to play the sitar properly? Will I even remember how to use a smartphone? It’s a weird mix of exciting and slightly terrifying, right? Especially when the thought of… you know… money comes into the picture. Specifically, retirement money.

For a long time, retirement felt like this abstract concept, something for “future me” to worry about. Like that pile of laundry I keep meaning to fold – it’ll just magically sort itself out, right? (Spoiler: it won’t, and neither will your retirement savings if you ignore them). But then, a few years ago, I had this mini-panic attack. I was chatting with a friend, Priya, who’s super on top of things (the kind of person who actually enjoys spreadsheets), and she casually mentioned she’d been playing around with a retirement calculator. A what-now? My brain did that record-scratch thing. I’d heard the term, vaguely, but it felt like some complicated financial tool for serious investors, not for someone like me who still occasionally buys things impulsively because they’re “cute.”

A retirement calculator is a powerful tool that estimates how much you need to save for retirement and helps you see if you’re on track to reach your goal. It’s a financial crystal ball that can predict your future, and using one is an eye-opening experience. Start using one now so your future self will thank you.

Why “Later” Usually Turns Into “Oh Crap, It’s Now!” (The Urgency of Early Planning)

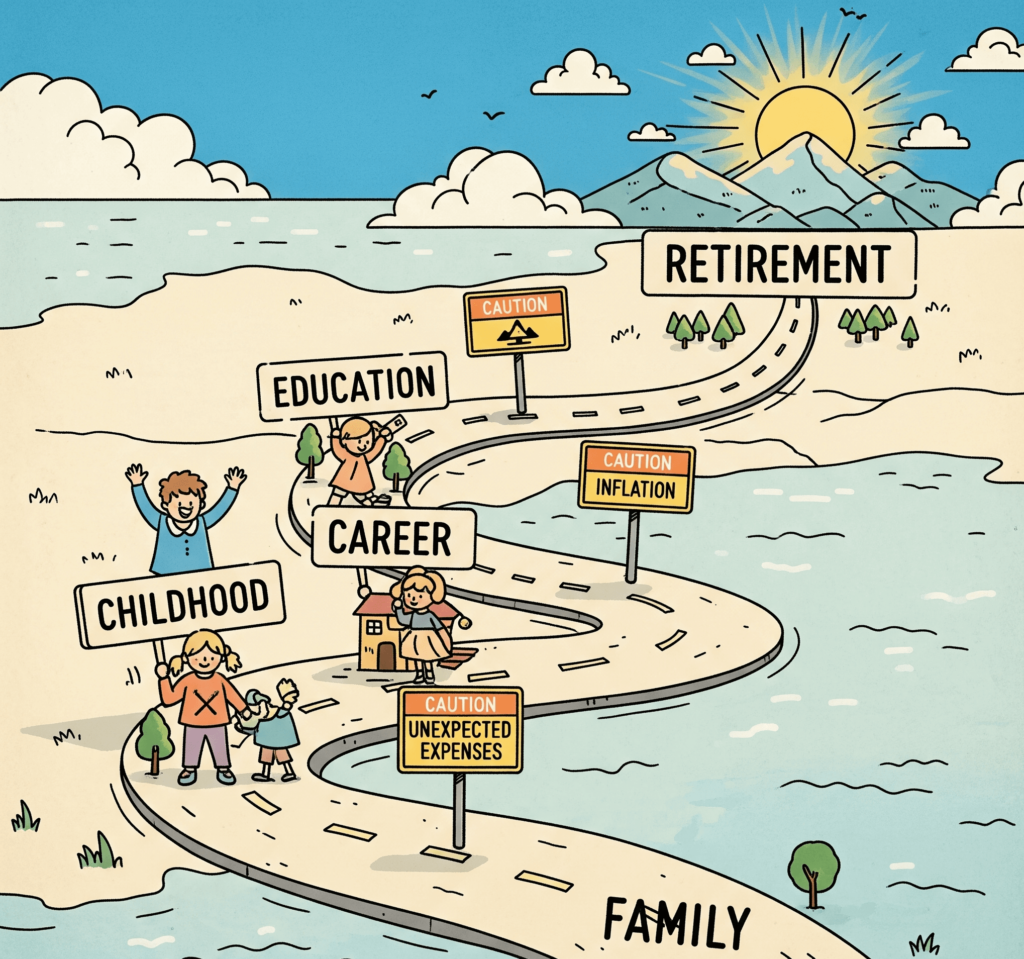

Let’s get real. Life happens. Unexpected expenses pop up (like that time my scooter needed a surprise repair… twice in one month!). You might want to travel, buy a house, maybe even help out family. Saving for retirement can often feel like it’s taking a backseat to more immediate needs and wants. It’s easy to think, “I’ll start saving more next year,” or “I’ll figure it out when I’m closer to retirement.” But here’s the thing: time is your biggest ally when it comes to retirement savings. The earlier you start, the more those sweet, sweet compound interest gains have time to work their magic.

Think of it like this: planting a seed. If you plant it early, it has more time to grow strong roots and blossom. If you wait until the last minute, you might still get a little sprout, but it won’t have the same robust foundation. And retirement? That’s a marathon, not a sprint. You need those years of compounded growth to really build a substantial nest egg.

I know, I know, thinking about retirement when you’re, say, in your 20s or 30s can feel like thinking about what you’ll have for dinner next Tuesday. It seems so far away! But that’s exactly why planning early is so crucial. It gives you more time to adjust your savings rate, make smarter investment decisions, and recover from any financial hiccups along the way. Plus, the sooner you have a rough idea of where you stand, the less likely you are to have a full-blown financial freakout later on. Trust me, that’s not a fun experience (I speak from a place of slight, past panic).

Decoding the Magic Box: How a Retirement Calculator Actually Works (It’s Not Scary, Promise!)

Okay, so what is this mystical retirement calculator anyway? It’s essentially a tool – often found for free on financial websites, brokerage firm sites, or even government resources – that helps you estimate your retirement needs based on a few key pieces of information. Don’t worry, you don’t need a PhD in finance to use one. They’re usually pretty user-friendly.

Here’s the kind of information you’ll typically need to input:

- Your Current Age:

- This helps the calculator determine how many years you have until your estimated retirement age.

- Your Desired Retirement Age:

- This is the age at which you plan to stop working. (Think carefully about this one! Do you envision yourself still in the office at 70, or are you dreaming of early retirement on a beach somewhere?)

- Your Current Annual Income:

- This gives the calculator a baseline for estimating your future income needs.

- Your Current Retirement Savings:

- This includes any money you already have in 401(k)s, IRAs, brokerage accounts earmarked for retirement, etc. (Don’t be discouraged if this number is small or even zero! That’s okay, you’re planning early!)

- Your Estimated Annual Retirement Expenses:

- This is where things get a little… guesstimate-y. Think about how much money you’ll likely need each year in retirement to cover your living expenses (housing, food, healthcare, travel, hobbies, etc.). Some calculators offer rules of thumb (like aiming for 70-80% of your pre-retirement income), but it’s good to think about your own lifestyle. Will you still be eating out a lot? Do you plan to travel extensively?

- Your Estimated Rate of Return on Investments:

- This is an educated guess about how much your investments will grow each year, on average. This is usually expressed as a percentage. Be realistic here! While high returns are great, it’s often wise to use a more conservative estimate, especially when planning for the long term.

- Your Estimated Inflation Rate:

- Inflation erodes the purchasing power of your money over time. This input helps the calculator account for that.

Once you plug in these numbers, the retirement calculator will do its mathematical magic and give you an estimate of how much you’ll need to have saved by retirement and whether you’re currently on track to meet that goal based on your current savings rate.

Playing the “What If?” Game: Why Retirement Calculators Are Your New Best Friend

The real power of a retirement calculator isn’t just in getting that initial estimate. It’s in the ability to play around with the different inputs and see how those changes impact your long-term outlook. This is where you can really start to take control of your retirement planning.

Here are some “what if?” scenarios you can explore:

- What if I save just a little bit more each month? Even small increases in your savings rate can have a significant impact over the long term, thanks to compounding. Try bumping up your monthly contributions by $50 or $100 and see how it changes your projected retirement savings. You might be surprised!

- What if I retire a few years earlier or later? Delaying retirement by even a few years can make a big difference. You’ll have more time to save, and you’ll have fewer years of retirement to fund. Conversely, retiring early requires a much larger nest egg.

- What if my investment returns are higher or lower than expected? This can help you understand the impact of market volatility and the importance of choosing appropriate investments for your risk tolerance and time horizon.

- What if my retirement expenses are higher or lower than I initially thought? Maybe you’re planning an epic round-the-world trip every year in retirement, or maybe you envision a simpler lifestyle. Adjusting your estimated expenses will give you a more realistic picture of your needs.

Playing these “what if?” scenarios can be really motivating. It can help you see the tangible impact of your savings decisions today on your future self. It’s no longer just some abstract number; it becomes a concrete goal you’re actively working towards.

Common Pitfalls and How to Avoid Them (Because Life Isn’t Always Predictable)

While retirement calculators are super helpful, it’s important to remember that they’re based on estimates and assumptions. Life has a funny way of throwing curveballs, so it’s crucial to be aware of some common pitfalls:

- Underestimating Retirement Expenses: Many people underestimate how much they’ll actually need in retirement, especially when it comes to healthcare costs. It’s often wise to err on the side of caution here.

- Forgetting About Inflation: Inflation can significantly erode your purchasing power over several decades. Make sure the calculator you’re using accounts for inflation.

- Not Being Realistic About Investment Returns: While it’s tempting to plug in optimistic return rates, it’s generally better to use more conservative estimates, especially for the long term.

- Ignoring Potential Income Sources: Don’t forget to factor in potential Social Security benefits, pensions, or other sources of retirement income. However, it’s also wise not to rely solely on these, as they can be subject to change.

- Not Updating Your Plan Regularly: Your financial situation and life goals will likely change over time. Make it a habit to revisit your retirement calculator and adjust your plan at least once a year, or whenever you experience a major life event.

I remember when I first used a retirement calculator, I totally forgot to factor in potential healthcare costs. When I ran the numbers again with a more realistic estimate, it was… sobering. But it was also a good wake-up call to start saving even more diligently. It’s better to face those realities now than to be surprised later.

Beyond the Basics: Other Factors to Consider (Because It’s Not Just About the Numbers)

While retirement calculators are a fantastic starting point, they don’t capture everything. Here are a few other important factors to think about:

- Your Lifestyle Goals: What do you envision doing in retirement? Traveling the world? Starting a new hobby? Spending more time with family? Your lifestyle aspirations will heavily influence how much money you’ll need.

- Healthcare Costs: As mentioned earlier, healthcare can be a significant expense in retirement. Research potential healthcare costs and consider how you’ll cover them.

- Long-Term Care: This is another often-overlooked expense. Consider whether you might need long-term care in the future and how you would pay for it.

- Taxes in Retirement: Remember that your retirement income will likely be taxed. Factor in potential tax implications when estimating your needs.

- Leaving a Legacy: Do you plan to leave money to your children or other beneficiaries? This will also impact your retirement savings goals.

Thinking about these factors can help you create a more comprehensive and personalized retirement plan that goes beyond just the numbers spit out by a calculator.

My Totally Unsolicited (But Hopefully Helpful) Advice from Jaipur

Look, I get it. Thinking about retirement when you’re young can feel like planning for a party that’s happening a million years from now. But trust me, that time will come faster than you think. And the more you plan early, the more secure and enjoyable your future self will be.

So, my friend, take a few minutes today – seriously, right now if you can – and play around with a retirement calculator. It’s free, it’s easy to use, and it can be a real eye-opener. It might even motivate you to make some small changes in your savings habits that will have a huge impact down the road. Think of it as a gift to your future self. A gift of financial security, peace of mind, and maybe even that porch swing you’ve always dreamed of. Now, if you’ll excuse me, I’m off to find a good sitar teacher. Retirement planning has me feeling inspired!

Outbound Link Suggestion 1: A link to a reputable free online retirement calculator, like the one offered by NerdWallet or Fidelity. Outbound Link Suggestion 2: A relatable blog post from someone who started saving for retirement late and their experience.