Okay, let’s be real for a sec. You’re in your 30s. Maybe you’re crushing your career, maybe you’re just trying to make it to Friday. Either way, that little voice in the back of your head has probably started whispering about… escape. Freedom. Not having to set an alarm clock. Yeah, we’re talking about early retirement. And while it might sound like some far-off fantasy reserved for lottery winners and tech billionaires, the truth is, there are actually early retirement strategies you can start at 30 that can make this dream a reality.

Now, when I say “early retirement,” I’m not necessarily talking about sipping margaritas on a private island by the time you’re 35 (though, if you figure that out, please, for the love of all that is holy, tell me your secrets!). For most of us normal folks, it’s about reaching a point where work becomes optional, where your investments and passive income streams can cover your living expenses. It’s about having the freedom to choose what you do with your time, whether that’s traveling the world, finally learning to play the ukulele, or just spending more time with your dog (who, let’s be honest, is probably judging your current work-life balance anyway).

I’ve been on this whole “figure out my life” journey for a while now, and the idea of financial independence and retiring early (aka, the FIRE movement) has definitely caught my attention. It sounds wild, right? Leaving the traditional career path decades before everyone else? But when you break it down, it’s really about making smart choices now so you have more options later. And guess what? Your 30s are the perfect time to start laying that foundation. So, ditch the doom-scrolling for a bit, grab your favorite questionable snack (mine’s currently stale biscuits dipped in leftover pickle juice – don’t judge me), and let’s dive into some actionable steps.

The Non-Negotiables: Laying the Groundwork for Early Retirement

Before we get into the fun stuff, there are a few foundational principles you absolutely, positively need to nail down if you’re serious about retiring early. Think of these as the spinach you have to eat before you get dessert.

1. Know Your Number: The Key to the Escape Hatch

This is the big one. You need to figure out how much money you’ll actually need to live comfortably in retirement. This isn’t just a random guess. You need to estimate your future annual expenses and then multiply that by 25 (this is a common rule of thumb based on the 4% withdrawal rule, which suggests you can safely withdraw 4% of your investment portfolio each year without running out of money).

- Example (Totally Made Up Numbers): Let’s say you estimate you’ll need $50,000 a year to live on in retirement. Multiply that by 25, and you get $1,250,000. That’s your FIRE number.

- My Messy Math: My own number still feels like a moving target, mostly because I can’t decide if my retirement will involve a fleet of rescue dogs and a tiny house or a nomadic existence with a backpack and questionable hostel choices. But having a ballpark figure is crucial.

2. Track Your Spending: Where Does All Your Money GO?!

Seriously, this is eye-opening. You’d be surprised how much you spend on things you don’t even really care about. Use a budgeting app, a spreadsheet, or even just jot things down in a notebook for a month or two. Knowing where your money is going is the first step to redirecting it towards your early retirement goals.

- Relatable Moment: I once tracked my spending for a month and discovered I was spending an embarrassing amount on delivery fees for food I could have easily cooked at home. It was a “facepalm” moment, for sure.

3. Get Rid of High-Interest Debt: The Anchor Dragging You Down

Credit card debt, high-interest personal loans – these are like anchors weighing down your financial ship. Focus on paying these off as aggressively as possible. Every dollar you save on interest is a dollar you can put towards your early retirement fund.

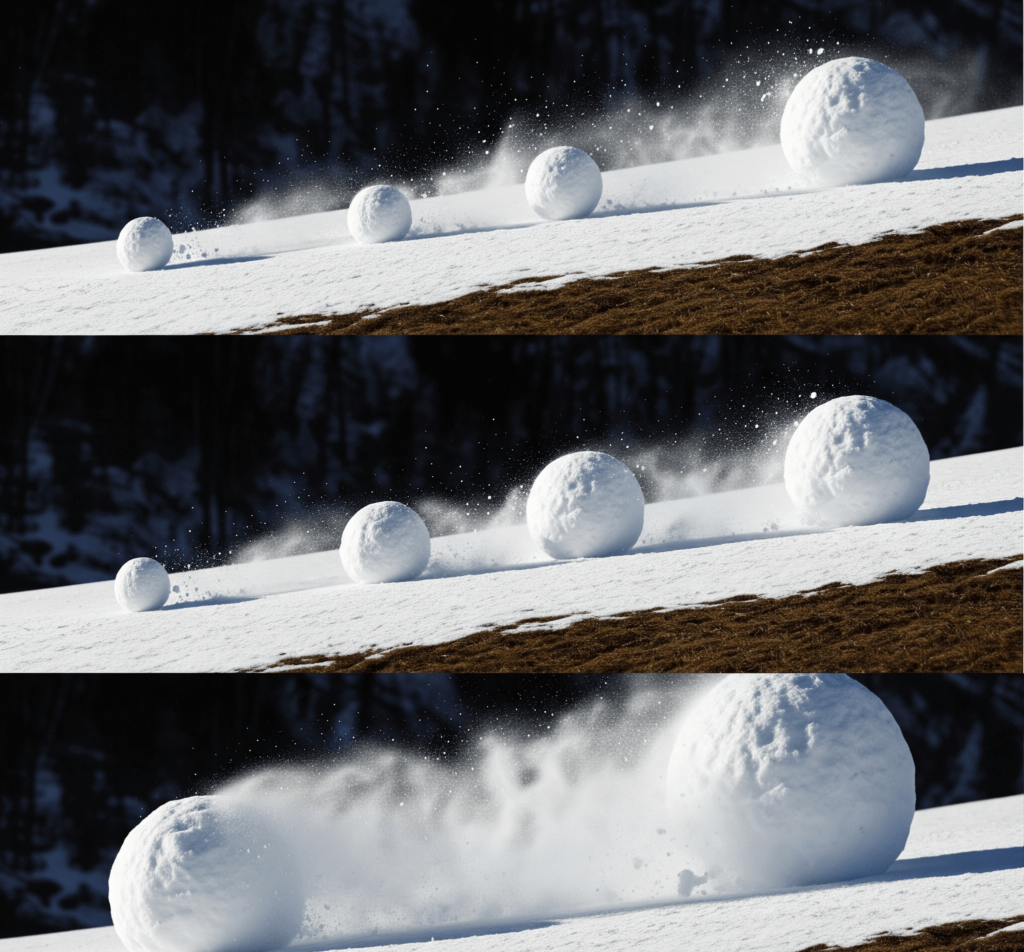

- Pro-Tip: The snowball or the avalanche method – pick the one that motivates you the most and attack that debt with gusto!

The Fun Part: Early Retirement Strategies You Can Start Implementing NOW

Alright, the groundwork is laid. Now for the exciting stuff – the actual strategies you can start using in your 30s to accelerate your journey to early retirement.

1. Supercharge Your Savings Rate: The Most Powerful Lever

This is the single biggest factor you can control. The more you save and invest, the faster you’ll reach your FIRE number. Aim to save a significant portion of your income – way more than the standard 15% retirement advice. Think 25%, 50%, or even more if you can swing it.

- How to Do It: Look for ways to cut expenses (we’ll get to that in a bit), automate your savings so the money goes into your investment accounts before you even see it, and whenever you get a raise or a bonus, put a big chunk of it towards your goals.

2. Embrace Frugality (Without Becoming a Hermit): Living Intentionally

Frugality isn’t about deprivation; it’s about being intentional with your spending and prioritizing what truly brings you value. It’s about saying “no” to things that don’t matter so you can say “yes” to early retirement.

- Easy Wins: Cook more meals at home, find free or cheap entertainment, cut unnecessary subscriptions, shop secondhand, and be mindful of your spending habits.

- My Quirky Frugality: I still rock clothes I bought in college (some with questionable fashion choices, I admit), and I’ve become a master at finding free events in my city. My friends tease me, but my bank account is laughing.

3. Maximize Tax-Advantaged Retirement Accounts: Free Money, Yes Please!

Take full advantage of your 401(k), Roth IRA, Traditional IRA, HSA (if you have a high-deductible health plan – it’s a triple tax advantage!), and any other tax-advantaged accounts available to you. The tax benefits can significantly accelerate your wealth growth.

- The Goal: Aim to max out your contributions each year if possible. Even if you can’t max them out right away, contribute as much as you can. Every little bit helps.

4. Explore Side Hustles and Increase Your Income: More Fuel for the Fire

Saving more is crucial, but so is earning more. Consider starting a side hustle that aligns with your skills or interests. Extra income can be directly funneled into your early retirement fund, speeding up the process considerably.

- Ideas: Freelancing, online tutoring, selling goods on Etsy, driving for a rideshare service (in your spare time, of course!), or leveraging a hobby into a money-maker.

5. Invest Aggressively (Smartly): Time is Your Ally

Since you have a longer time horizon in your 30s, you can afford to take on more risk with your investments. Consider a portfolio that’s heavily weighted towards stocks, as they have historically provided higher returns over the long term. As you get closer to your target retirement age, you can gradually shift towards a more conservative allocation.

- Keep it Simple: Low-cost index funds and ETFs are a great way to diversify your portfolio without paying high fees.

6. Location Arbitrage (Consider a Change of Scenery): Your Dollars Go Further

This one’s a bit more drastic, but if you’re serious about retiring early, consider whether you might be able to live more affordably in a different location, either now or in retirement. Lower cost of living means you need less money to reach your FIRE number.

- Think About: Smaller towns, different states, or even international destinations can offer significantly lower living expenses. My friend Emily actually moved to a smaller city with a lower cost of living and was able to drastically increase her savings rate.

7. Downsize Your Life: Less Stuff, More Freedom

Do you really need that giant house with the huge mortgage? Or that fancy car payment? Downsizing your lifestyle can free up a significant amount of money that can be put towards your early retirement goals. Plus, less stuff often means less stress and more freedom.

- Consider: A smaller home, a more fuel-efficient car, or simply decluttering and selling things you no longer need.

8. Continuous Learning and Skill Development: Investing in Yourself

The more valuable your skills are, the more earning potential you have. Continuously invest in learning new skills or improving your existing ones. This can lead to higher income in your current career or open up opportunities for more lucrative side hustles.

9. Plan for Healthcare Costs: The Elephant in the Room

Healthcare is a major expense, especially in the US. If you’re planning on retiring early, you need to have a solid plan for how you’ll cover your healthcare costs before you’re eligible for Medicare (typically at age 65). This might involve exploring options like the Affordable Care Act marketplace, health savings accounts, or potentially even working part-time to maintain employer-sponsored insurance.

10. Stay the Course and Avoid Lifestyle Creep: The Long Game

The journey to early retirement is a marathon, not a sprint. There will be times when you feel like you’re not making progress fast enough, or when you’re tempted to splurge on something you don’t really need. Stay focused on your goals, celebrate small victories, and avoid lifestyle creep (where your spending increases as your income increases). That new shiny thing will be forgotten, but the freedom of early retirement? That’s priceless.

It’s Not a Sprint, It’s a Marathon (With Plenty of Snack Breaks, Hopefully!)

Look, I’m not going to sugarcoat it. Pursuing early retirement takes discipline, planning, and sometimes making sacrifices. It’s not always easy saying no to that fancy vacation or the latest gadget. But the potential payoff – the freedom to live life on your own terms, decades earlier than most – is, in my opinion, totally worth it.

Starting in your 30s gives you a significant advantage. Time is your biggest ally when it comes to investing and compounding. So, don’t feel like you’ve missed the boat if you haven’t started already. The best time to plant a tree (or start your early retirement journey) was 20 years ago. The second best time is now.

What are your thoughts on early retirement? Any strategies you’re already using or considering? Let’s chat in the comments – maybe we can all inspire each other to ditch the rat race a little sooner!

Outbound Links:

- Mr. Money Mustache – A popular blog about achieving financial independence (Warning: He’s intense, but his principles are solid!).

- ChooseFI Podcast – Interviews and discussions about Financial Independence, Retire Early (Great for listening on your commute or while doing those frugal chores!).