The one where you open your bank app, squint at the balance, and a little piece of your soul just… shrivels up? Yeah. That Financial hardship. It’s a gut-punch. A cold, hard dose of reality that hits you right in the chest. I’ve been there. Like, truly, deeply, living-on-ramen-and-questioning-my-life-choices-at-3-a.m.-staring-at-the-ceiling been there. And let me tell you, when you’re in the middle of it, the idea of how to overcome financial hardship feels about as realistic as winning the lottery on a Tuesday.

But here’s the thing. It’s not a permanent address. It’s just a stop. A really crummy, anxiety-inducing stop on a long, messy road trip called life. And I want to tell you, from one messy human to another, that you can totally get past this. It’s not easy, and it’s not always pretty—trust me, my journey was a comedy of errors and panicked Google searches—but it’s possible.

So grab a cup of coffee (or, let’s be real, whatever questionable instant stuff you have in the back of the cupboard) and let’s chat. No judgment here. Just a friend who’s been there, done that, and maybe has a few embarrassing stories to share.

1. The Panic-Pantry Financial Method: Getting Real About Your Money (and Your Snacks)

Okay, first things first. Before you can even think about a plan, you have to know where you stand. I call this the “Panic-Pantry Method” because it’s a lot like when you realize you’re out of groceries and you have to take stock of every weird can and box you have shoved in the back of your pantry.

You gotta face the numbers. I know. It sucks. It’s terrifying. It feels like you’re opening a box full of spiders that are all going to jump out and tell you you’re a failure. But you gotta do it.

Here’s the drill financial hardship:

- List every single dollar you have.

- (Don’t forget that random $17 you stashed in an old jacket pocket. That’s a win!)

- List every single bill you have coming up.

- Rent, utilities, car payment, that one subscription service you totally forgot about (Disney Plus, I’m looking at you).

- List all your debt.

- Credit cards, student loans, that time you borrowed money from your cousin and swore you’d pay them back “next week.” Be honest. No one’s looking. (Except maybe your cousin.)

I remember the first time I did this. I sat at my kitchen table with a legal pad and a cheap pen, and I just… started writing. The numbers were like a horror movie. My eyes got wide, my stomach dropped, and I seriously considered just throwing the pen out the window and pretending it never happened. But I didn’t. And when I was done, even though it was a total disaster on paper, I felt a weird sense of calm. Because for the first time, I wasn’t just scared of an invisible monster in the dark. I had a picture of the monster. And you can’t fight something you can’t see.

This is the very first step in managing money during a tough time. It’s not about finding a magical solution right away. It’s about getting a clear, painful, but necessary picture of your financial reality.

2. The Great Budgeting Bonanza: It’s Not a Straightjacket, I Swear!

Now that you know what you’re dealing with, you need a budget. I used to think of a budget like a financial diet—all deprivation, no fun. But I’ve learned it’s more like a recipe. You can still have a delicious meal, you just have to measure the ingredients.

I use a ridiculously simple spreadsheet for this. It has two columns: “Money In” and “Money Out.” That’s it. In the “Money In” column, you put your income. In the “Money Out” column, you list your expenses, from rent and electricity to that absurdly expensive coffee you buy every morning. (You know the one.)

Here’s the trick, though: you have to track everything. Every dollar. For a while, I used to buy stuff and then just… forget. I’d be like, “Where did my money go?” And then I’d check my statement and see ten different coffee charges from that week and be like, “Oh. Right.” It’s wild how those little things add up. So, track it all. For a month or two, just write it down. You’ll be shocked.

My friend, Sarah, once told me she tracked her spending for a month and found out she was spending, like, a hundred bucks a month on snacks from vending machines at work. A hundred bucks! She totally lost it. But once she knew, she could change it. That’s the power of the budget. It’s not about judging you; it’s about giving you the data to make better choices. It’s a tool, not a punishment. sign of strength, not weakness.

3. The Side Hustle Shuffle: Making Extra Cash Without Losing Your Mind

When your budget is telling you you’re in a hole, sometimes you just gotta start shoveling. And by shoveling, I mean finding ways to bring in more money. This is where the whole “side hustle” thing comes in.

Now, I’m not talking about quitting your day job and starting a million-dollar company. I’m talking about small, manageable things you can do on the side to pad your bank account a little.

Think about what you’re good at. Are you a pro at walking dogs? Can you write a decent blog post? (I can, apparently.) Do you love organizing closets? There’s a side hustle for almost anything.

I’ve done a bunch of these, and some have been… interesting. I tried to sell a bunch of old clothes on a resale app and ended up just getting a bunch of weird lowball offers. (Seriously, one person offered me $3 for a brand-new jacket. I cracked me up.) But I also started doing some freelance writing on the side, and that actually worked out. It was a little bit of extra cash that made a huge difference.

- Gig Economy Apps: Driving for a ride-share service, delivering food, or even doing odd jobs.

- Freelancing: If you have a skill like writing, graphic design, or coding, you can find freelance work online.

- Selling Stuff: Clean out your closet, your garage, your attic. Sell your old junk on sites like Facebook Marketplace or eBay.

It’s about finding something that fits your life, not something that’s going to drain you even more. It’s about building a little financial cushion, one small gig at a time. It’s a key step in learning how to overcome financial hardship.

4. Talk to Someone financial hardship: A Guide to Debt and Tough Conversations

This is the scariest part, so let’s get it out of the way. If you have debt, you gotta talk to someone about it. I know, I know. It feels like admitting you’ve failed. But you haven’t. You’re just facing a challenge. financial hardship.

I was so ashamed of my debt for a long time. I would get calls from creditors and just let them go to voicemail, heart pounding, like I was in a movie and the bad guy was calling. It was a terrible, awful feeling. But one day, I just answered.

And the person on the other end wasn’t a monster. They were just… a person.

- Call Your Creditors: Yes, it’s uncomfortable. But you can often negotiate a lower payment or a different payment plan. They want to get paid, and they’ll often work with you.

- Talk to a Non-Profit Credit Counselor: Seriously. These people are saints. They can help you create a debt management plan and can often get interest rates lowered. I know this sounds super formal and not like a friend giving you advice, but seriously, this is one of the best financial tips I could ever give you.

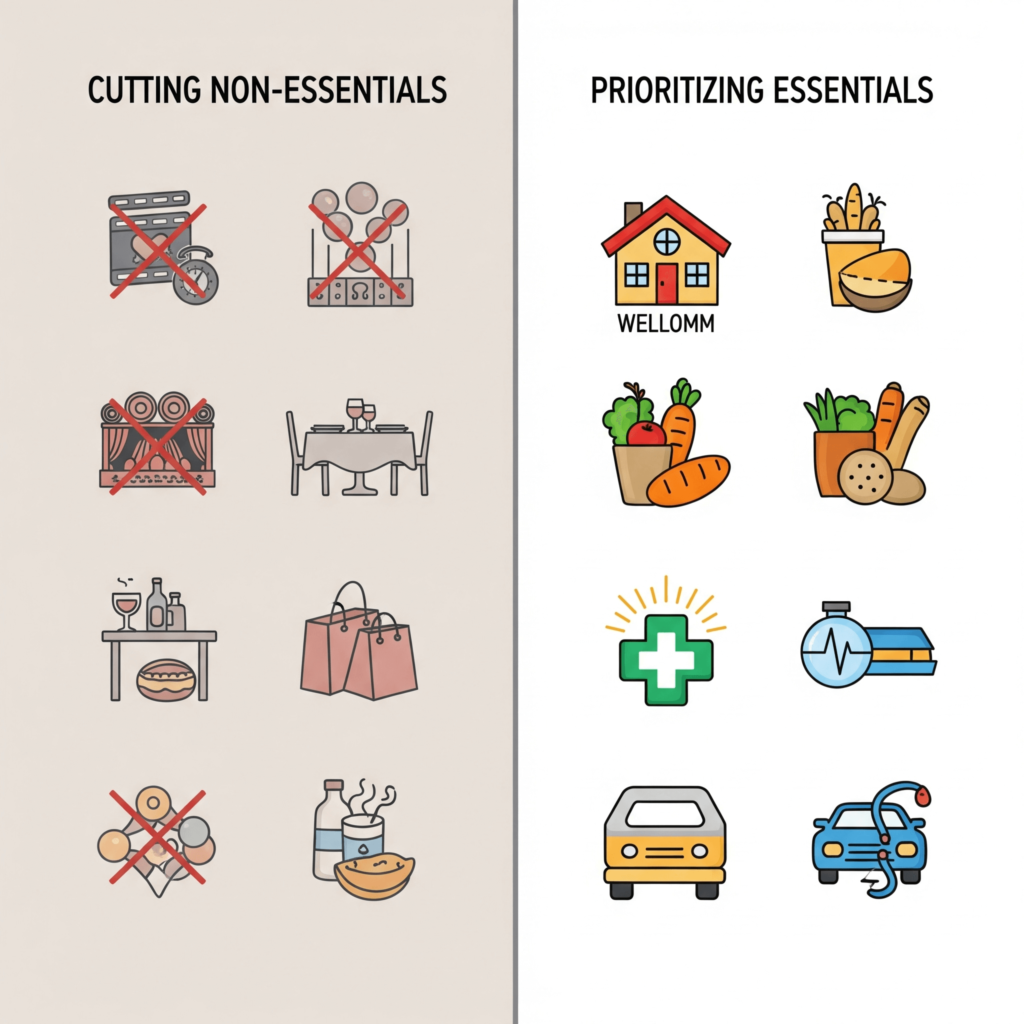

- Don’t Touch That Credit Card: If you’re struggling, cut it up. Freeze it in a block of ice. Do whatever you have to do to stop using it. It’s like pouring gasoline on a fire.

It’s okay to ask for help. It’s a sign of strength, not weakness. You don’t have to carry this burden alone. Remember when I wore two different shoes to school in 8th grade? Not on purpose, of course. My friends totally roasted me, but we all laughed about it later. The point is, embarrassing moments are just moments. They don’t define you. And this? This is just a moment, too essentials. He cut these immediately. He also contacted his bank and negotiated a temporary reduction in his loan payments. By actively managing his expenses and seeking help, Rajesh was able to stay afloat while searching for new employment.

5. financial hardship Mindset Matters: The Most Important Tool in Your Toolkit

This last one is the hardest and the most important financial hardship. Your mindset.

When you’re broke, it’s so easy to feel like a failure. To feel like you’re alone. To feel like you’ll never dig yourself out. Your brain tells you all kinds of mean things. It’s like having a tiny, grumpy gremlin living in your head, whispering doubts into your ear.

You have to tell that gremlin to shut up.

- Celebrate Small Wins: Did you stick to your grocery budget this week? YES! Did you pay off a tiny bit of debt? YOU’RE A ROCKSTAR! Don’t wait for a huge milestone to feel proud of yourself. Every small step is a step forward.

- Be Kind to Yourself: You’re not perfect. You’re going to mess up. You’ll probably buy that expensive coffee again. And that’s okay. Just get back on track the next day. It’s a marathon, not a sprint.

- Find Free Fun: You don’t need money to have a good time. Go for a walk in the park. Binge-watch a show on a friend’s streaming service (with their permission, of course). Have a game night with friends. Creativity is your best friend right now.

I remember one weekend when I was really struggling, I decided to just go for a long walk in the woods near my house. No money spent. Just fresh air and trees. And in that quiet, I realized that my worth wasn’t tied to my bank account. It sounds cheesy, I know, but it’s true. It was a turning point for me.

So, there you have it. My messy, imperfect guide to getting through a tough financial spot. It’s not a magic fix, and it’s not a straight line. You’ll have good days and bad days. But you can do this. You’re stronger and more capable than you think. And hey, you’ve got a friend cheering you on. Now go kick that gremlin out of your brain challenging journey, but by implementing these Top 5 Ways to Overcome Financial Hardship, you can take control and build a path towards financial stability. Remember to be proactive, seek support when needed, and celebrate small victories along the way. With perseverance and the right strategies, you can overcome these difficulties and create a more secure financial future for yourself and your family in Jaipur, or wherever you may be.