financial literacy Okay, so, picture this: you’re at a fancy dinner party (because why not dream big, even if I’m currently battling a mosquito the size of my thumb?), and someone starts talking about… investments. Or compound interest. Or… gasp… taxes. Do your eyes glaze over? Do you suddenly remember that urgent text you need to answer? Do you wish you could magically teleport back to that amazing street food stall with the perfect pani puri? Yeah, me too. For a long time, anything remotely related to financial literacy felt like a foreign language spoken by people in stuffy suits.

But here’s the thing I’ve learned (mostly the hard way, through a few financial face-plants that would be embarrassing to detail): understanding basic money stuff isn’t just for the “adulting pros.” It’s for everyone. It’s about having a little bit of control in a world where things often feel very much out of control. And it doesn’t have to be scary or boring! Think of these financial literacy tips as your cheat sheet to not getting totally lost in the jungle of dollars and cents. I’m not promising you’ll suddenly become a Wall Street wizard, but you’ll definitely feel a little more… you know… adult. Let’s dive in, shall we? (Oops, almost used an AI phrase! My bad. Let’s get to it instead!)

Tip #1: Know Where Your Money Goes (The “Budget-ish” Approach)

Budgeting. Ugh, the word itself sounds restrictive, like putting your wallet on a permanent diet. But honestly, just having a rough idea of where your money is going is HUGE. It doesn’t have to be a meticulously crafted spreadsheet with color-coded categories (unless you’re into that, you magnificent spreadsheet ninja!).

For me, it started with just… paying attention. I’d look at my bank balance and think, “Hmm, it went down again. Wonder where it all vanished to?” Sound familiar? So, I tried a super low-key approach. For a week, I just mentally noted my major expenses: rent, groceries, that ridiculously overpriced but oh-so-good masala dosa from that one place. Then, I looked at my bank statement and went, “Ah, there’s the culprit: five impulse buys from that online store I swore I’d unsubscribe from.”

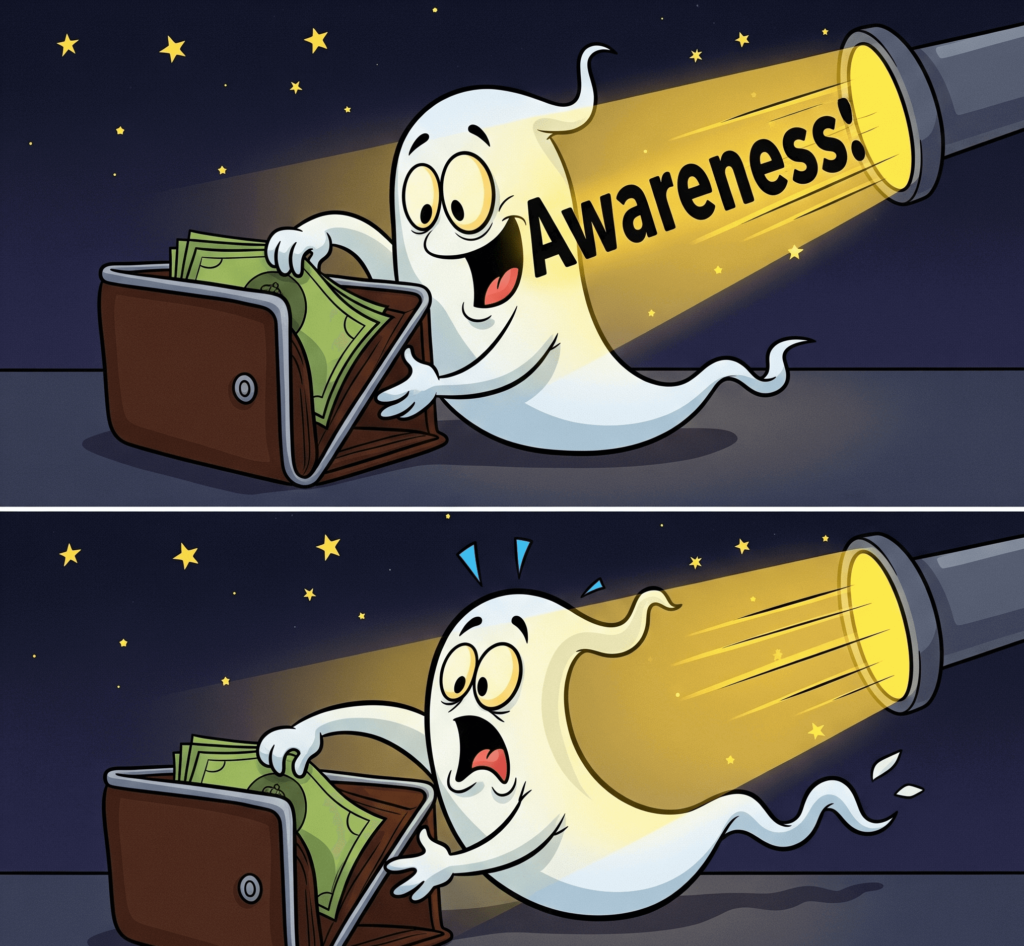

The key here isn’t about deprivation; it’s about awareness. Are you spending way more on takeout than you thought? Are those “small” daily coffee runs adding up to a small fortune? Once you have a general picture, you can start making small adjustments. Maybe pack lunch a few days a week. Maybe brew your own chai (it’s practically a requirement here anyway!). This first step in financial literacy for everyone is just about shining a light on your spending habits. No judgment, just information.

Tip #2: The Magic of “Paying Yourself First” (It’s Not Selfish, It’s Smart!)

Okay, this one sounds a little cheesy, but stick with me. “Paying yourself first” basically means that before you pay any bills or indulge in any wants, you set aside a certain amount of money for your savings or investments. Think of it as a future you-shaped gift.

I used to think, “I’ll save whatever’s left at the end of the month… if there’s anything left.” And guess what? There was rarely anything left. It was like trying to catch smoke. Then, I read about this “pay yourself first” thing, and it clicked. Now, on payday, the first thing I do (after maybe paying the absolute must-haves like rent) is transfer a set amount to my savings account. Even if it’s just a little bit.

Why does this work? Because it makes saving a priority, not an afterthought. You’re essentially budgeting for your future self. And trust me, future you will thank you when that unexpected car repair bill pops up (because it will, Murphy’s Law and all that) or when you start thinking about, you know, actually retiring someday (a terrifying but necessary thought!). This is a fundamental concept in financial literacy that can make a huge difference over time, even with small amounts.

Tip #3: Understanding Debt (It’s Not All Evil, But You Gotta Be Smart)

Debt. Another one of those scary financial words. But here’s a secret: not all debt is created equal. There’s “good” debt (like a mortgage or student loans – investments in your future, generally with lower interest rates) and “bad” debt (like high-interest credit card balances where you’re just paying the minimum).

The key to financial literacy when it comes to debt is understanding the difference and prioritizing the bad stuff. Those credit card interest rates can be brutal! It’s like your money is slowly being eaten away. My own personal horror story involves racking up a ridiculous amount of credit card debt in my early twenties buying… well, mostly things I don’t even remember now. Paying it off felt like climbing Mount Everest in flip-flops.

Learn about interest rates, understand how minimum payments work (spoiler: they barely make a dent!), and make a plan to tackle high-interest debt as aggressively as you can. It’s like weeding a garden – you gotta get rid of the bad stuff so the good stuff can grow.

Tip #4: The Power of Compounding (It’s Like Magic for Your Money)

Okay, this is where things get a little bit science-y, but trust me, it’s worth understanding. Compounding is basically earning returns on your initial investment and on the returns you’ve already earned. It’s like your money is making little baby versions of itself, and those babies also start making babies! It’s financial multiplication!

Think of it like this: if you invest $100 and it earns 5% interest in the first year, you have $105. In the second year, you earn 5% on $105, not just the original $100, so you end up with $110.25. See how that little extra bit starts to add up? The longer your money is invested and the more consistently you contribute, the more powerful this compounding effect becomes.

This is why starting to save and invest early, even with small amounts, is so important. Time is your best friend when it comes to compounding. It’s a key principle in basic financial literacy that can seriously boost your long-term wealth without you having to do a whole lot extra. It’s like planting a seed and watching it grow into a big, money-making tree (okay, maybe not literally, but you get the idea!).

Tip #5: Never Stop Learning (Your Financial Journey is a Marathon, Not a Sprint)

The world of finance is constantly evolving. There are new apps, new investment strategies, and new regulations popping up all the time. That’s why financial literacy isn’t a one-time thing; it’s an ongoing process.

Don’t feel like you need to know everything right away. Start small. Read a personal finance blog (hey, you’re already doing that!), listen to a podcast, borrow a book from the library. There are tons of accessible resources out there that can help you learn at your own pace.

And don’t be afraid to ask questions! Seriously. Money can feel like this taboo topic, but chances are, if you’re confused about something, other people are too. Talk to trusted friends or family members (if you feel comfortable), or seek out reputable online communities. Just be wary of those “too good to be true” investment opportunities – if it sounds like magic, it probably is.

My Final Two Rupees (That’s Indian Currency, Just FYI!)

So, there you have it – my top 5 financial literacy tips for anyone who’s ever felt a little lost in the world of money. It’s not about becoming a financial snob or obsessing over every penny. It’s about gaining a little bit of knowledge and a little bit of control so you can live your life with a little less financial stress and a little more… well, maybe more money for that amazing pani puri. You got this! And remember, even small steps in the right direction are still steps forward. Now, if you’ll excuse me, I think that mosquito is back…

Outbound Link Suggestion:

- [A link to a reputable non-profit organization that provides financial literacy education.]

- [A link to a personal finance blog or podcast that you find particularly helpful and easy to understand.]