Financial literacy tips are, like, my desperate attempt to stop my bank account from laughing at me, yo. I’m typing this in my cluttered Denver apartment, surrounded by empty Monster cans, a pile of crumpled receipts I’m too stressed to sort, and, for real, a sink full of dishes I swore I’d do last Friday. My cat’s batting at a stray pen, and my phone’s buzzing with bank alerts I’m too nervous to open. I’m 30, grinding retail with a wallet that’s basically a sad meme, trying to master money management skills in 2025. So, here’s my sloppy, embarrassing take on 5 financial literacy tips everyone should know, packed with my dumb money mistakes and personal finance hacks I’ve learned the hard way.

Why Financial Literacy Tips Are My Lifeline

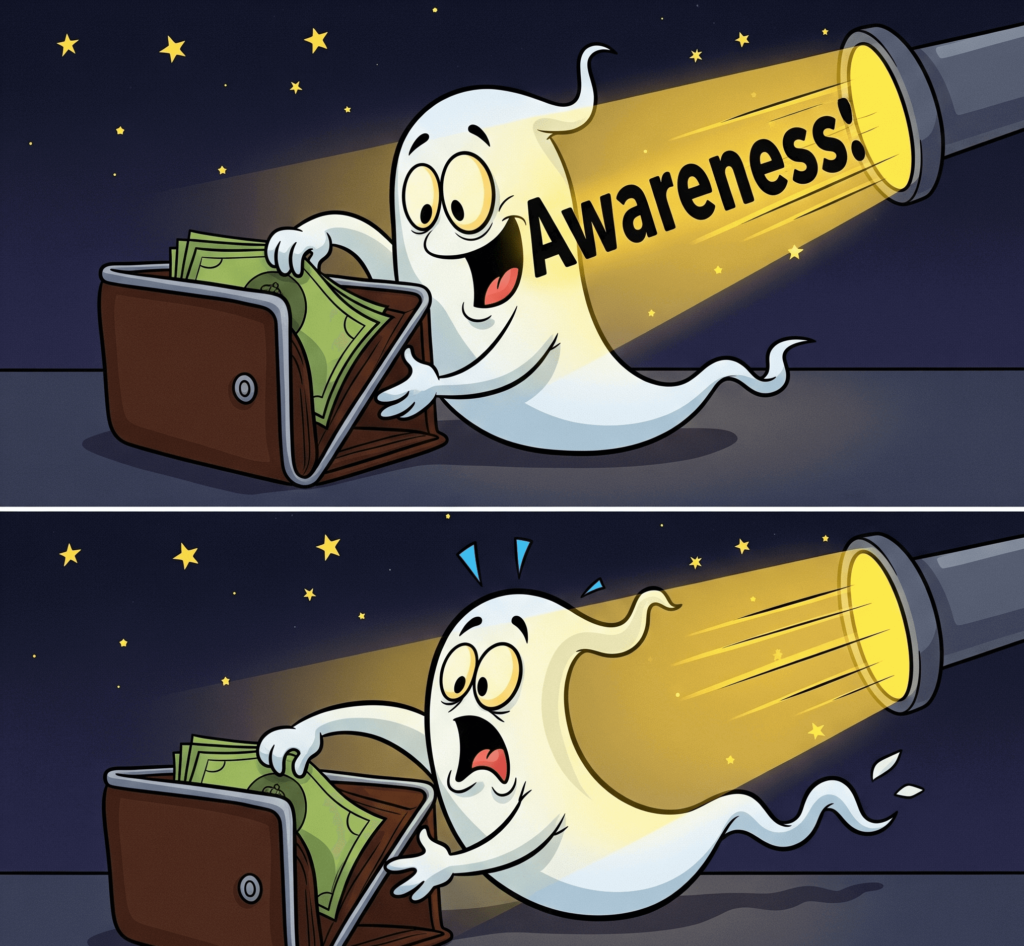

I’m legit awful at budgeting basics. For instance, I once spent $300 on “collectible” Funko Pops thinking they were an “investment”—yep, I was eating a burrito in my car when I realized they were worth $30. However, financial literacy tips can keep your money from vanishing into thin air. In fact, I read on NerdWallet that basic budgeting can save 20% of your income, which is enough to make me rethink my taco obsession. Consequently, these financial education tips are my attempt to keep my finances from being a total dumpster fire.

5 Financial Literacy Tips to Save Your Wallet

Alright, here’s my rundown of 5 financial literacy tips everyone should know, based on my chaotic attempts to not stay broke. I’ve tried some, totally botched some, and, frankly, learned a bit along the way.

- Track Your Spending: Use apps like YNAB to see where your money goes. NerdWallet loves this (check NerdWallet).

- My Dumb Moment: I thought “tracking” meant “check my balance once.” Got hit with fees.

- Budget Like a Pro: Set limits for every category. Bankrate explains (see Bankrate).

- Cringe Alert: I budgeted $100 for “vibes” and went broke.

- Save First: Put 10% into savings before spending. Forbes has details (see Forbes).

- Oops: I saved $5 and spent $50 on tacos.

- Understand Debt: Know interest rates and pay off high ones first. Investopedia covers this (check Investopedia).

- My Fail: I paid minimums on a 20% interest card. Ouch.

- Learn Investing Basics: Start with low-cost ETFs. Kiplinger recommends (see Kiplinger).

- Embarrassing Bit: I emailed a broker “yo, is an ETF a crypto?” Kill me now.

How I Keep Screwing Up Financial Literacy Tips

Real talk: personal finance hacks are not my forte. For example, I once spent hours on X scrolling “financial education 2025” instead of cutting my streaming subscriptions—classic procrastination move. Nevertheless, here’s what I’ve learned from my chaos:

- Check Your Spending Daily: I ignored my budget and got overdraft fees. So, use an app, yo.

- Don’t Impulse Buy: I bought a “deal” speaker and tanked my savings. Hence, pause before spending.

- Ask for Advice: I DM’d a money-savvy friend on X, and they dropped dope tips. Network, y’all.

- Stick to the Plan: I ignored my budget and blew $200 on takeout. Instead, commit.

Forbes says money management skills can save 15-20% of your income, which I’m trying to nail without derailing again (see Forbes).

Finding Your Own Financial Literacy Tips Groove

Mastering financial literacy tips is, like, picking a burrito topping—personal and a little overwhelming. Here’s my advice, straight from my burrito-crumb-covered couch:

- Know Your Money Vibe: I’m broke, so I focus on small wins. What’s your financial vibe?

- Start Small, Dude: Don’t overhaul everything at once. I did and, for real, crashed hard. Pick one or two hacks.

- Use Cool Resources: Forbes and NerdWallet have dope info. Bankrate’s budgeting tools are clutch too.

- Track Your Progress: I check my spending every Sunday. Sounds nerdy, but, honestly, it keeps me sane.

Wrapping Up My Financial Literacy Tips Chaos

So, yeah, I’m still a hot mess with financial literacy tips, sitting here in my Denver chaos with my cat judging my broke life. I’ve cried over bank fees, eaten too many burritos while stressing, and, for real, still forget to check my budgeting app half the time. But, nevertheless, these 2025 money tips have kept me from totally tanking.

Outbound Link Suggestion:

- [A link to a reputable non-profit organization that provides financial literacy education.]

- [A link to a personal finance blog or podcast that you find particularly helpful and easy to understand.]