How to use a retirement calculator to plan early is something I’ve been stressing about, mostly ‘cause I’m sitting in my cluttered San Diego apartment, the ocean breeze sneaking through a cracked window, and my desk’s a warzone of empty LaCroix cans and half-read self-help books. The air smells like salty air and burnt toast—don’t ask—and I’m scrolling NerdWallet on my phone, trying to figure out if I’ll ever retire or just live in a van by the beach. Like, seriously? I got into this after overhearing some surfer dude at a Pacific Beach café bragging about his “early retirement plan,” and I was like, “Yo, I’m out here with $200 in savings.” So, here’s my totally unpolished, slightly embarrassing take on how to use a retirement calculator to plan early, straight from my frazzled American brain.

How to Use a Retirement Calculator: The Basics

Getting Started with Retirement Calculators for Early Planning

Alright, let’s break it down. A retirement calculator’s like a crystal ball for your money—it crunches numbers to tell you how much you need to save for retirement. I found some solid ones on Bankrate and Vanguard. I was munching on a soggy burrito last week when I first tried Bankrate’s calculator, thinking I’d be chilling in Hawaii by 50. Spoiler: I’m not. Here’s the core of how to use a retirement calculator, based on my fumbling:

Check Results: It spits out a number, like $1M. I saw mine and nearly choked on my burrito.

Input Your Age: Tell it how old you are now and when you wanna retire. I put 65, then panicked and changed it to 55.

Add Income and Savings: Be honest about your cash flow. I lowballed mine ‘cause I’m paranoid about oversharing.

Estimate Expenses: Guess how much you’ll spend in retirement. I forgot to include tacos—big mistake.

My Most Embarrassing Retirement Calculator Flop

How I Screwed Up Using a Retirement Calculator

True story: I thought I was a retirement planning pro after watching one YouTube video. I was at a Mission Beach coffee shop, hyped on cold brew, plugging numbers into a calculator on Fidelity. I accidentally entered my monthly rent as my annual income—yep, off by a factor of 12. The calculator told me I’d need $10M to retire, and I legit thought I was doomed. The barista saw my screen and gave me this pitying look, like, “Girl, you okay?” I had to restart from scratch, and Investopedia saved me with a guide on realistic inputs.

Another flop? I forgot to account for inflation. My calculator said I’d need $500K, but that’s in today’s dollars. Rookie mistake, and it freaked me out.

Tips to Use a Retirement Calculator to Plan Early

How to Actually Use a Retirement Calculator Without Losing It

So, how do you use a retirement calculator to plan early without spiraling? I’m still learning, but here’s what I’ve picked up from my chaos, backed by Forbes:

- Be Honest: Input real numbers for income and savings. I fudged mine and got useless results.

- Account for Inflation: Most calculators have an inflation option—use it. I learned 3% is a safe bet.

- Test Scenarios: Try different retirement ages or savings rates. I played with retiring at 60 vs. 65, and it was eye-opening.

- Save Regularly: Calculators show how small savings add up. I started putting $50 a month into a 401(k) after this.

Seeing my savings goal drop by $100K when I upped my monthly contributions felt like a tiny win, but I’m still scared I’ll mess it up.

Why Using a Retirement Calculator Matters for Early Planning

Why Bother with a Retirement Calculator to Plan Early?

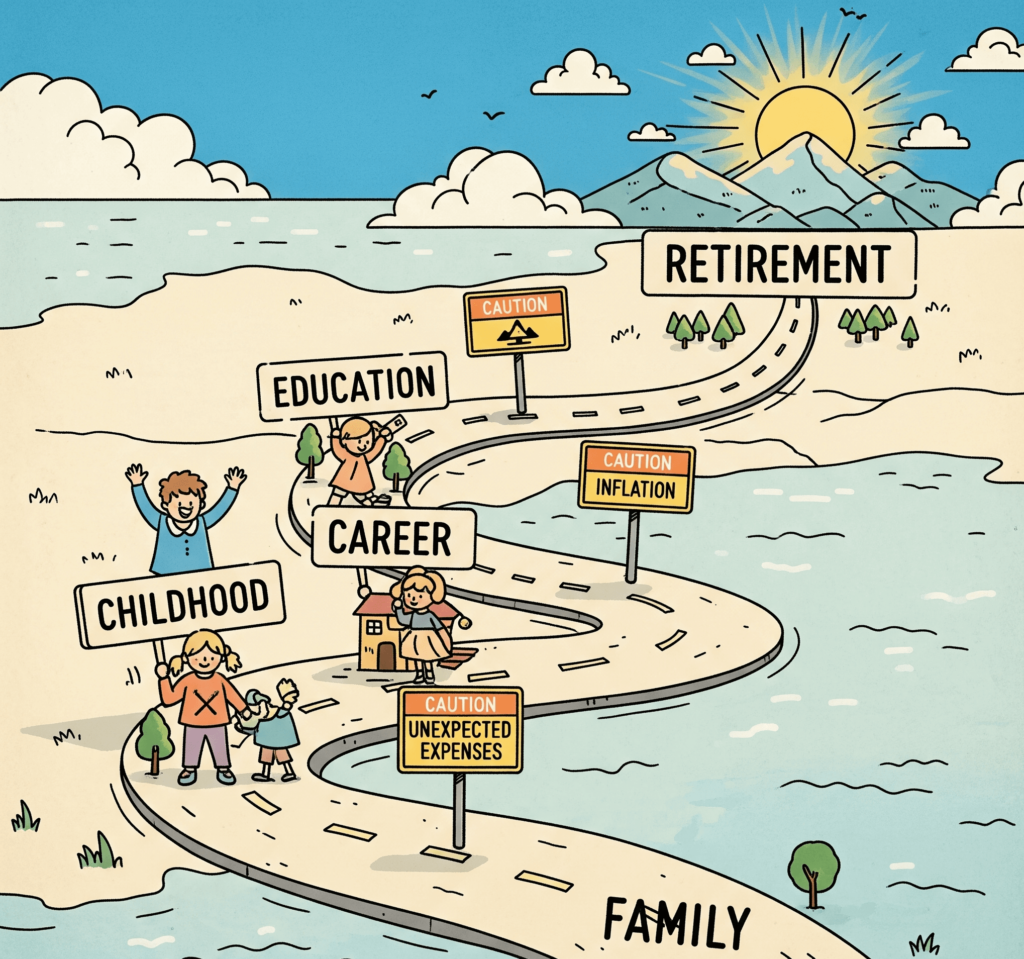

Why even mess with how to use a retirement calculator? ‘Cause it’s like a reality check for your future self. It shows you if you’re on track to chill on a beach or work ‘til you’re 80. I learned this the hard way when I got rejected for a car loan ‘cause my savings were nonexistent. A calculator helps you set goals, even if they feel impossible. I’m torn, though—I love dreaming of retirement, but the numbers stress me out.

Wrapping Up My Retirement Calculator Rant

So, that’s my sloppy take on how to use a retirement calculator to plan early. I’m still here, ocean breeze mocking me, coffee cups judging my life choices, dreaming of a retirement that doesn’t involve instant ramen. These calculators are legit for getting your act together, but they’re only as good as the numbers you put in. If you’re as lost as me, try one on Bankrate or Vanguard and start small. Got your own retirement planning horror stories? Spill in the comments, I’m nosy.

Outbound Link Suggestion 1: A link to a reputable free online retirement calculator, like the one offered by NerdWallet or Fidelity. Outbound Link Suggestion 2: A relatable blog post from someone who started saving for retirement late and their experience.