Overcome financial hardship? Yo, that’s my desperate mission to stop my bank account from screaming at me every month. I’m typing this in my messy Denver apartment, surrounded by empty seltzer cans, a pile of unpaid bills I’m too stressed to touch, and, for real, a sink full of dishes I swore I’d do last Tuesday. My cat’s batting at a stray pen, and my phone’s buzzing with bank alerts I’m too scared to open. I’m 30, grinding retail with a bank balance that’s basically a sad emoji, trying to figure out financial recovery in 2025. So, here’s my sloppy, embarrassing take on the top 5 ways to overcome financial hardship, packed with my dumb money mistakes and money struggles tips I’ve learned the hard way.

Why Overcoming Financial Hardship Is My Panic Mode

I’m legit awful at dodging money struggles. For instance, I once spent $200 on “limited edition” sneakers thinking they’d resell—yep, I was eating a burrito in my car when I realized they were worth $20. However, overcome financial hardship strategies can pull you out of the broke zone if you don’t mess it up. In fact, I read on NerdWallet that cutting expenses by 20% can free up cash fast, which is enough to make me rethink my takeout addiction. Consequently, these financial survival tips are my attempt to keep my wallet from being a total dumpster fire.ng you; it’s about giving you the data to make better choices. It’s a tool, not a punishment. sign of strength, not weakness.

Top 5 Ways to Overcome Financial Hardship in 2025

Alright, here’s my rundown of top 5 ways to overcome financial hardship based on my chaotic attempts to not stay broke. I’ve tried some, totally botched some, and, frankly, learned a bit along the way.

My Fail: I spent my “emergency fund” on tacos.ay afloat while searching for new employment.

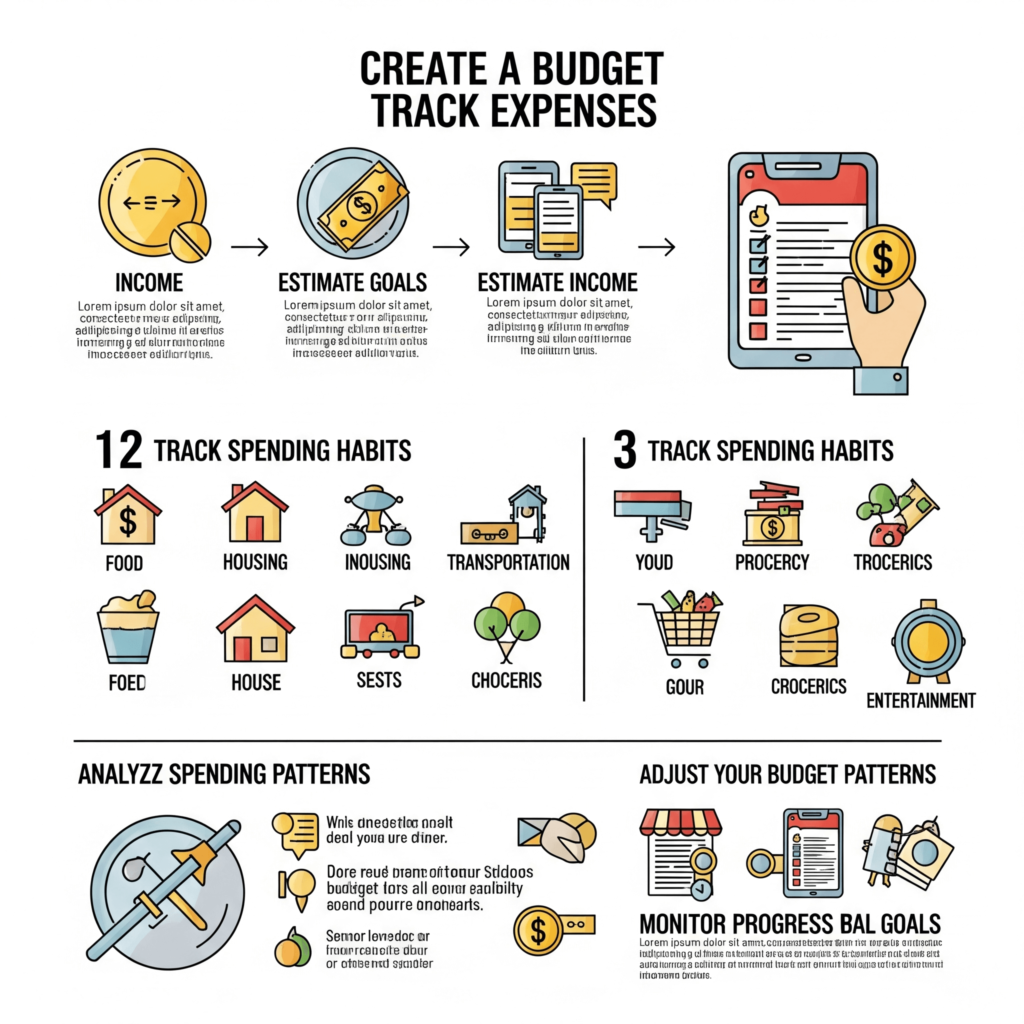

Slash Your Spending: Track every penny and cut ruthlessly. NerdWallet loves budgeting apps like YNAB (check NerdWallet).

My Dumb Moment: I thought “budget” meant “skip one coffee.” Got hit with a $100 overdraft.

Negotiate Bills: Call companies to lower rates. Forbes has tips (see Forbes).

Cringe Alert: I begged my cable company to “chill” and got nowhere.

Side Hustle Hard: Drive for Uber or sell stuff online. Bankrate covers this (check Bankrate).

Oops: I tried selling “vintage” socks and made $2.

Debt Relief Programs: Consolidate or settle debt. Credit Karma explains (see Credit Karma).

Embarrassing Bit: I emailed a debt counselor “yo, can you erase my debt?” Kill me now.

Emergency Fund: Save even $10 a week. Investopedia recommends (see Investopedia).

How I Keep Screwing Up Overcoming Financial Hardship

Real talk: financial recovery is not my forte. For example, I once spent hours on X scrolling “get out of debt 2025” instead of canceling my streaming subscriptions—classic procrastination move. Nevertheless, here’s what I’ve learned from my chaos:

- Track Every Dollar: I ignored my spending and got hit with fees. So, use a budget app, yo.

- Don’t Impulse Buy: I bought a “deal” phone and tanked my savings. Hence, pause before spending.

- Ask for Advice: I DM’d a money-savvy friend on X, and they dropped dope tips. Network, y’all.

- Stick to the Plan: I ignored my budget and blew $150 on takeout. Instead, commit.

Finding Your Own Overcome Financial Hardship Groove

Figuring out how to overcome financial hardship is, like, picking a burrito topping—personal and a little stressful. Here’s my advice, straight from my burrito-crumb-covered couch:

- Know Your Limits: I’m broke, so I focus on small wins. What’s your money vibe?

- Start Small, Dude: Don’t try every hack at once. I did and, for real, crashed hard. Pick one or two.

- Use Cool Resources: NerdWallet and Forbes have dope info. Bankrate’s budget tools are clutch too.

- Track Your Progress: I check my spending every Sunday. Sounds nerdy, but, honestly, it keeps me sane.

Wrapping Up My Overcome Financial Hardship Chaos

So, yeah, I’m still a hot mess trying to overcome financial hardship, sitting here in my Denver chaos with my cat judging my broke life. I’ve cried over bank fees, eaten too many burritos while stressing, and, for real, still forget to check my budget app half the time. But, nevertheless, these 2025 money hacks have kept me from totally tanking. Check out NerdWallet or Forbes for more get out of