Alright, my fellow dreamers and aspiring couch potatoes (in the best possible way, I promise!), let’s talk about the holy grail of financial goals: making money while you’re, well, not actively making money. We’re talking about passive income ideas that actually work. It sounds like something from a late-night infomercial, right? Like, “Buy this magic bean, and you’ll be rich by morning!” And look, I get it, a lot of what you hear out there is total garbage. I once bought into a “get rich quick” scheme that involved selling… well, let’s just say it involved a lot of brightly colored plastic and exactly zero profit. Live and learn, right?

I’ve been rambling on this blog for a decent chunk of time, and if there’s one topic that always makes eyeballs light up (mine included!), it’s the idea of working less and earning more. Because who doesn’t want to wake up, check their phone, and see that money just… appeared? It’s not magic, it’s strategy. It’s planting a seed, nurturing it, and then watching it grow while you go live your life. Which, let’s be honest, probably involves more Netflix and less actual gardening. That’s fine!

I’ve tried a few of these myself, learned some hard lessons, celebrated some small wins, and I’m here to tell you, it’s totally achievable. It’s not always “passive” from day one – most require some upfront effort, some learning, some trial and error (like my plastic toy saga). But once they’re set up, they can genuinely become income streams that flow even when you’re on vacation, binge-watching your favorite show, or, you know, actually sleeping. So, grab your favorite beverage, kick back, and let’s dive into some real talk about how to make your money work harder for you.

The Core Truth: What “Passive” Really Means (and What It Doesn’t)

Okay, before we get into the nitty-gritty, let’s clarify. “Passive” income doesn’t mean zero work. It means upfront work, or ongoing minimal work. It’s building a machine that, once built, mostly runs itself. Think of it like this:

- Active Income: You trade time for money. (Your 9-5 job.)

- Passive Income: You trade initial time/money for ongoing money. (The machine you built.)

My friend Dave once tried to tell me he was making passive income by “thinking really hard about winning the lottery.” Bless his heart. That’s not how it works. You gotta put in some effort first!

10 Passive Income Ideas That Actually Work (From Easy-ish to “Okay, Maybe Later”)

I’ve broken these down a bit, from things that are relatively low-effort/low-initial-cost (but might take time to grow) to things that require more upfront investment or skill.

1. High-Yield Savings Accounts (HYSA) & CDs: The Bare Minimum Effort

- What it is: Instead of letting your money sit in a regular savings account earning like, 0.01% (which is basically nothing, thanks big banks!), you put it in an HYSA or a Certificate of Deposit (CD) where it earns significantly more interest.

- How it works: You just… put your money there. That’s it. The bank pays you interest. CDs lock your money up for a set period (like 6 months or 2 years) for a guaranteed rate, usually higher than an HYSA.

- My Take: This is the most passive. It requires almost no effort once set up. It won’t make you rich, but it’s better than letting inflation eat away at your cash. It’s like finding money in your couch cushions, but consistently. It’s also a good place for your emergency fund, earning a little something while it waits.

- Effort Level: 😴😴😴 (Sleepy, minimal effort)

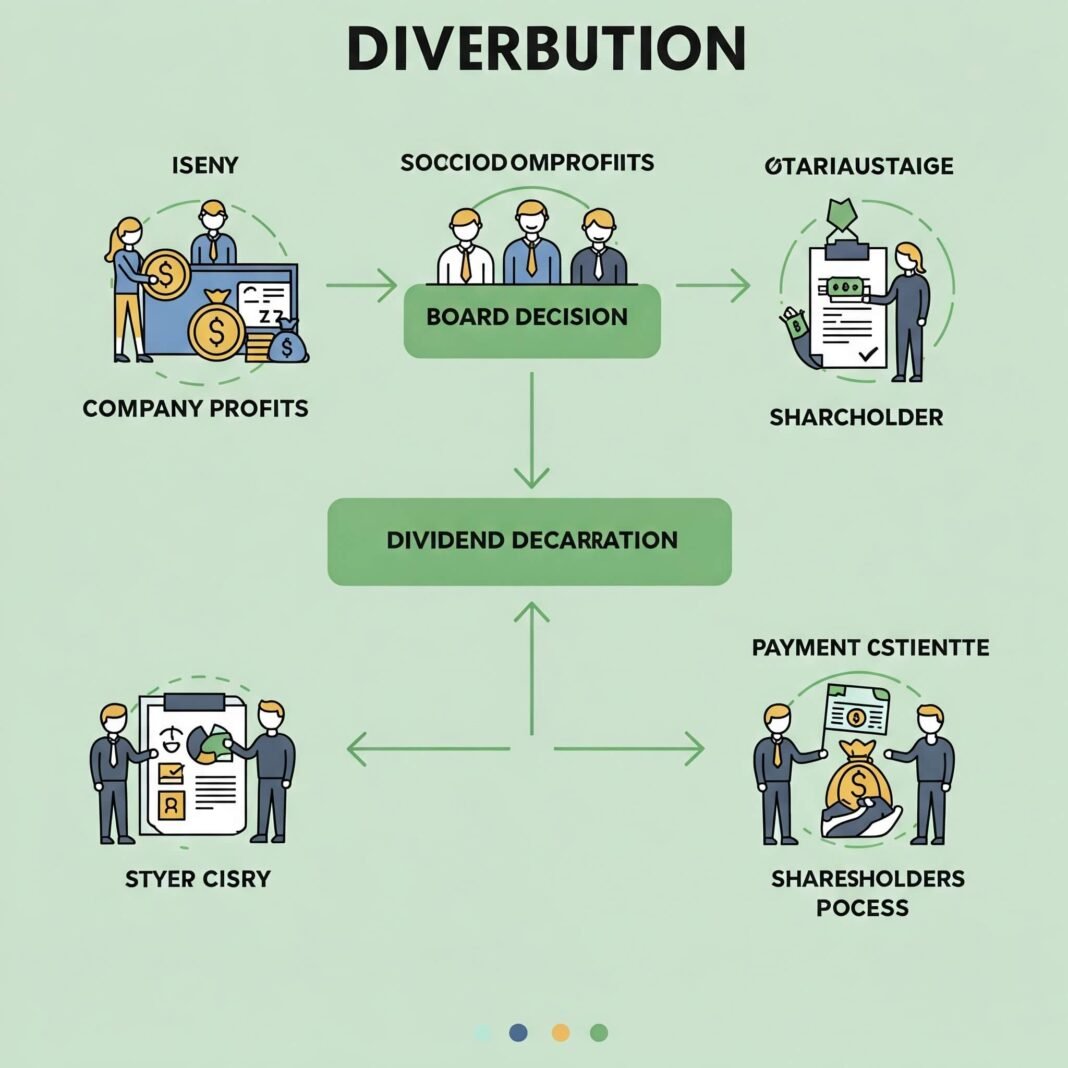

2. Dividend Stocks & ETFs: Investing for Regular Payouts

- What it is: You buy shares of companies (or ETFs, which are collections of stocks) that regularly pay out a portion of their profits to shareholders – these are called dividends.

- How it works: You invest in these companies, and then you just receive payments (usually quarterly) for owning their stock. The money just hits your brokerage account. Magic!

- My Take: This is a classic investment strategy for passive income. It requires research upfront (or investing in dividend ETFs to diversify easily). You can reinvest the dividends to buy more shares, compounding your growth. My friend Sarah (yes, the one who is good at everything) actually invests heavily in dividend stocks, and she uses the payouts for her annual vacation budget. Smart, right?

- Effort Level: 😴😴 (Some initial research, then pretty passive)

3. Real Estate Crowdfunding/REITs: Property Ownership Without the Headaches

- What it is: Instead of buying an entire physical property (and dealing with tenants, toilets, and busted pipes, ugh), you invest in real estate through crowdfunding platforms or Real Estate Investment Trusts (REITs).

- How it works:

- Crowdfunding: You pool your money with other investors to buy shares in larger commercial or residential properties. You get a share of the rental income or appreciation.

- REITs: These are companies that own income-producing real estate. You buy shares in the REIT, and they typically pay out a high percentage of their income in dividends.

- My Take: This is a fantastic way to get into real estate without actually becoming a landlord. I dabbled in a small REIT once, and it was interesting to see the payouts without having to fix anything. It’s still an investment, so there’s risk, but way less active than managing a rental.

- Effort Level: 😴😴 (Research platforms/REITs, then mostly passive)

4. Rental Properties (if you’re brave): The Classic, But Not So Passive

- What it is: You buy a property, rent it out to tenants, and collect rent.

- How it becomes passive: The goal is to hire a property manager who handles everything – finding tenants, collecting rent, fixing leaks, dealing with midnight emergencies.

- My Take: Okay, so this one can be highly active initially and if you don’t hire a property manager. I once helped a friend move out of her rental, and the sheer amount of work the landlord had to do to get it ready for the next tenant was mind-boggling. She basically became a project manager for three weeks. If you do hire a manager, it becomes passive, but that cuts into your profits. It’s definitely one of the passive income ideas that actually work, but requires significant upfront capital and can be a huge headache if you don’t manage it right.

- Effort Level: 😴😴😴 (If managed well) or 🏃♀️🏃♀️🏃♀️ (If you do it yourself!)

5. Create an Online Course or Digital Product: Share Your Brain!

- What it is: You create something once (an online course, an e-book, a template, digital art prints, stock photos, music beats, etc.) and sell it repeatedly online.

- How it works: You put in the upfront work to create high-quality content. Then you set up a platform (like Teachable, Gumroad, Etsy, stock photo sites, etc.) to sell it. Marketing is key, but once it’s out there, people can buy it anytime.

- My Take: This is where my own “side hustle” heart truly lies. I actually created a small e-book years ago about productivity tips (because my life is anything but productive, so I figure I’m an expert on what not to do!). It took forever to write and format, but now it just sits there, occasionally selling. It’s not life-changing money, but it’s cool to see notifications pop up that someone bought it while I was, say, arguing with my cat. It’s a great automated income stream if you have a skill or knowledge to share.

- Effort Level: 💪💪💪 (High upfront creation), then 😴😴 (Low ongoing marketing/maintenance)

6. Start a Blog/YouTube Channel with Affiliate Marketing or Ads: Content that Keeps Giving

- What it is: You create content (blog posts, videos) around a niche you love. Over time, as your audience grows, you can earn money through affiliate marketing (recommending products/services and earning a commission) or display ads (Google AdSense, etc.).

- How it works: The upfront effort is huge – consistently creating valuable content, building an audience, learning SEO (Search Engine Optimization), and setting up the monetization. But once you have established content and traffic, it can earn you money even when you’re not actively publishing.

- My Take: Well, you’re reading this, right? So, you know I believe in this one! It takes a ton of work to get going. Like, way more than I ever anticipated. There were months I thought, “Is anyone even reading this besides my mom?” But over time, if you keep at it, it can definitely become a source of side hustle income. My early blog posts were a mess, truly. Some probably still are! But consistency wins.

- Effort Level: 🏃♀️🏃♀️🏃♀️ (High upfront creation/marketing), then 😴😴 (Ongoing maintenance/monetization)

7. Peer-to-Peer (P2P) Lending: Be a Mini-Bank

- What it is: You lend money to individuals or small businesses through online platforms (like Prosper or LendingClub), and you earn interest on those loans.

- How it works: You choose which loans to fund (you can often invest small amounts across many loans to diversify risk). The platform handles the repayment and collections.

- My Take: This is fascinating but comes with risk. You could lose money if borrowers default. Diversification is key. It’s like being a tiny, tiny loan shark, but legal and much nicer. I haven’t personally tried this, but I have friends who swear by it as a way to get higher returns than traditional savings, but you gotta know what you’re doing.

- Effort Level: 😴😴 (Initial setup and portfolio management)

8. Rent Out Unused Space Income Ideas That Actually Work: Couch, Car, Spare Room

- What it is: You have something sitting around unused that someone else might pay to use. Think: a spare bedroom (Airbnb), a parking spot, your car (Turo), or even a storage space.

- How it works: You list your space/item on a platform, set your price, and handle the logistics.

- My Take: This is a classic make money while you sleep if you set it up well. My cousin rents out her spare bedroom on Airbnb a few weekends a month. She says it’s a bit of work initially (cleaning, photos, setting up the listing), but then it’s mostly just managing bookings and handing over keys. If you’re comfortable with strangers (or at least polite guests), this can be a solid earner. Just remember taxes!

- Effort Level: 💪💪 (Initial setup, some ongoing management)

9. Create and Sell Stock Photos/Videos/Music: Creative Assets That Keep Paying

- What it is: If you’re a photographer, videographer, or musician, you can license your creative works to stock agencies (like Shutterstock, Adobe Stock, Getty Images).

- How it works: You upload your high-quality assets. When someone downloads them, you get a royalty. One photo could earn you money for years.

- My Take: My friend, who’s an amazing photographer, does this. She says it’s a lot of work to shoot and edit the photos to meet agency standards, but once they’re approved, they just sit there, earning tiny bits of money every time they’re downloaded. It’s not a huge amount per download, but it adds up over time. It’s literally selling something once and getting paid for it forever. Income Ideas That Actually Work.

- Effort Level: 💪💪💪 (High upfront creation), then 😴😴 (Truly passive income once uploaded)

10. Build a Vending Machine Route: Old School, Still Works

Effort Level: 💪💪 (Upfront investment and setup), then 😴😴 (Regular but limited maintenance)

What it is: You buy vending machines, find locations for them, stock them, and collect the cash.

How it works: This requires upfront capital for machines and inventory, and then ongoing maintenance (restocking, fixing issues). But once you have a few machines in good locations, it can be quite hands-off. Income Ideas That Actually Work.

My Take: This one always makes me smile. It feels very old-school entrepreneur, like something from a movie. My uncle actually did this for a bit in the 90s, and he said it was surprisingly lucrative. He had a few machines in office buildings. It takes more work than a HYSA, obviously, but less than a full-time job. It’s a tangible way to build automated income.

The Real Talk: No Such Thing as “Zero Effort, Infinite Riches” (Sorry!)

I know, I know. It’s easy to get swept up in the “make money while you sleep” dream. But the absolute truth about all these passive income ideas that actually work is that they all require some level of upfront effort, time, or capital. Sometimes a lot of it.

- Time: Creating an online course, building a blog, taking stock photos.

- Money: Investing in stocks, buying a rental property, getting vending machines.

- Skill/Knowledge: Knowing what to invest in, what course to create, how to find good tenants.

The key is to pick something that aligns with your existing skills, interests, and resources. Don’t go buy a bunch of vending machines if you hate dealing with cash and driving around. Don’t try to build a tech empire if you can barely use a spreadsheet.

Start small. Experiment. Learn. My productivity e-book? It’s not a bestseller, but it’s something. It proves the concept. And that feeling of getting paid for something you did months ago? It’s pretty sweet. It’s what drives me to keep exploring more financial freedom strategies.

So, what are you waiting for? Pick one of these ideas, do your homework, and start building your own little money machine. You deserve to make your money work for you, even if you’re just chilling on the couch.

What passive income ideas have you tried? Any wins? Any hilarious failures? Share your stories below! We’re all in this journey to financial awesomeness together!

Cheers to more sleep and more money!

Outbound Links:

- Investopedia’s deeper dive into passive income (For when you want to get a bit more technical, but still understandable.)

- A funny take on side hustles gone wrong (because we’ve all been there!) (Disclaimer: McSweeney’s is satire, but the relatable angst is real!)